Terminal Ledger combines a professional trading journal with market research and intelligence tools. Track every trade, research with exclusive analytics, and build the discipline to become consistently profitable.

14-day free trial, no obligation

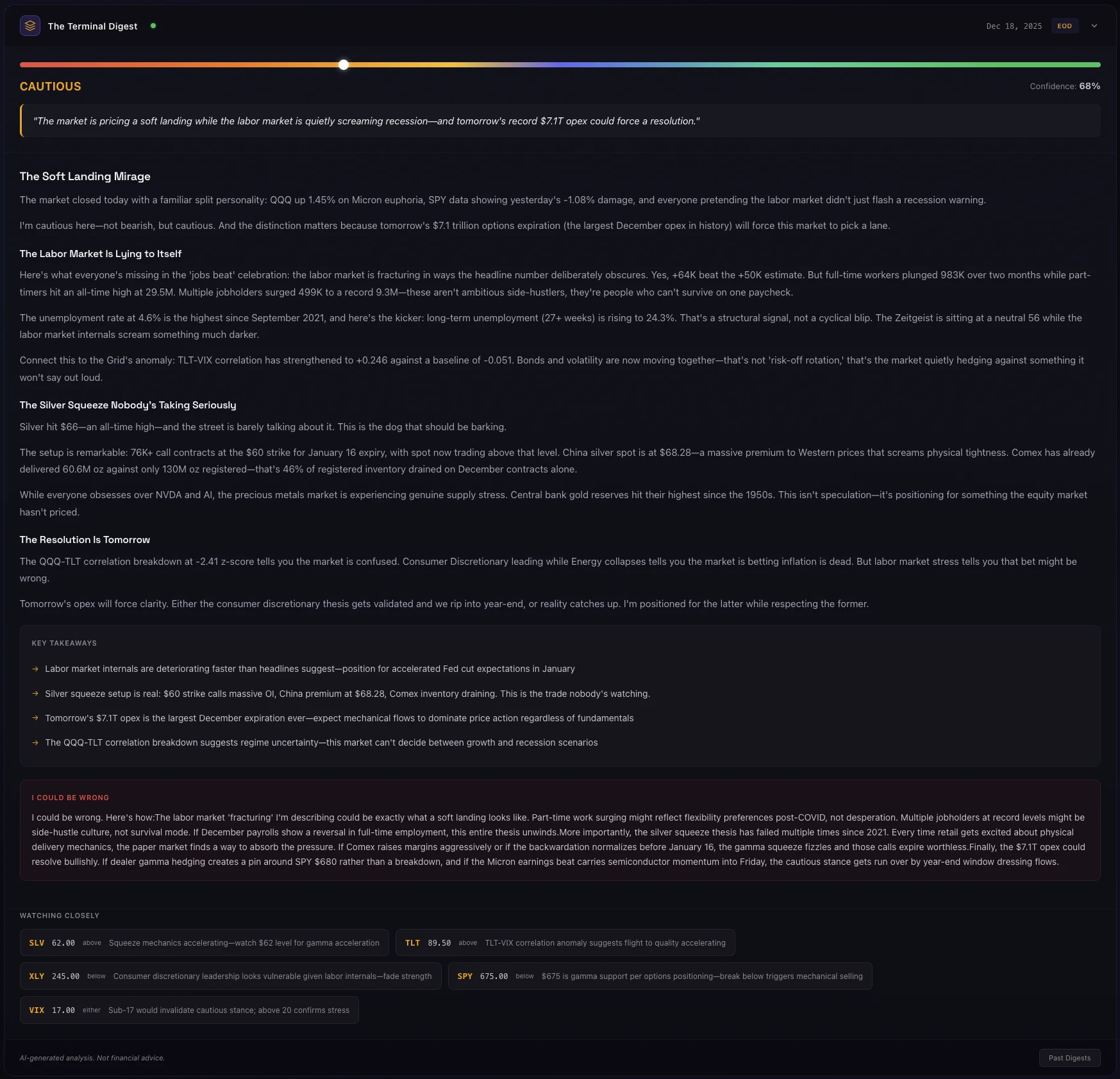

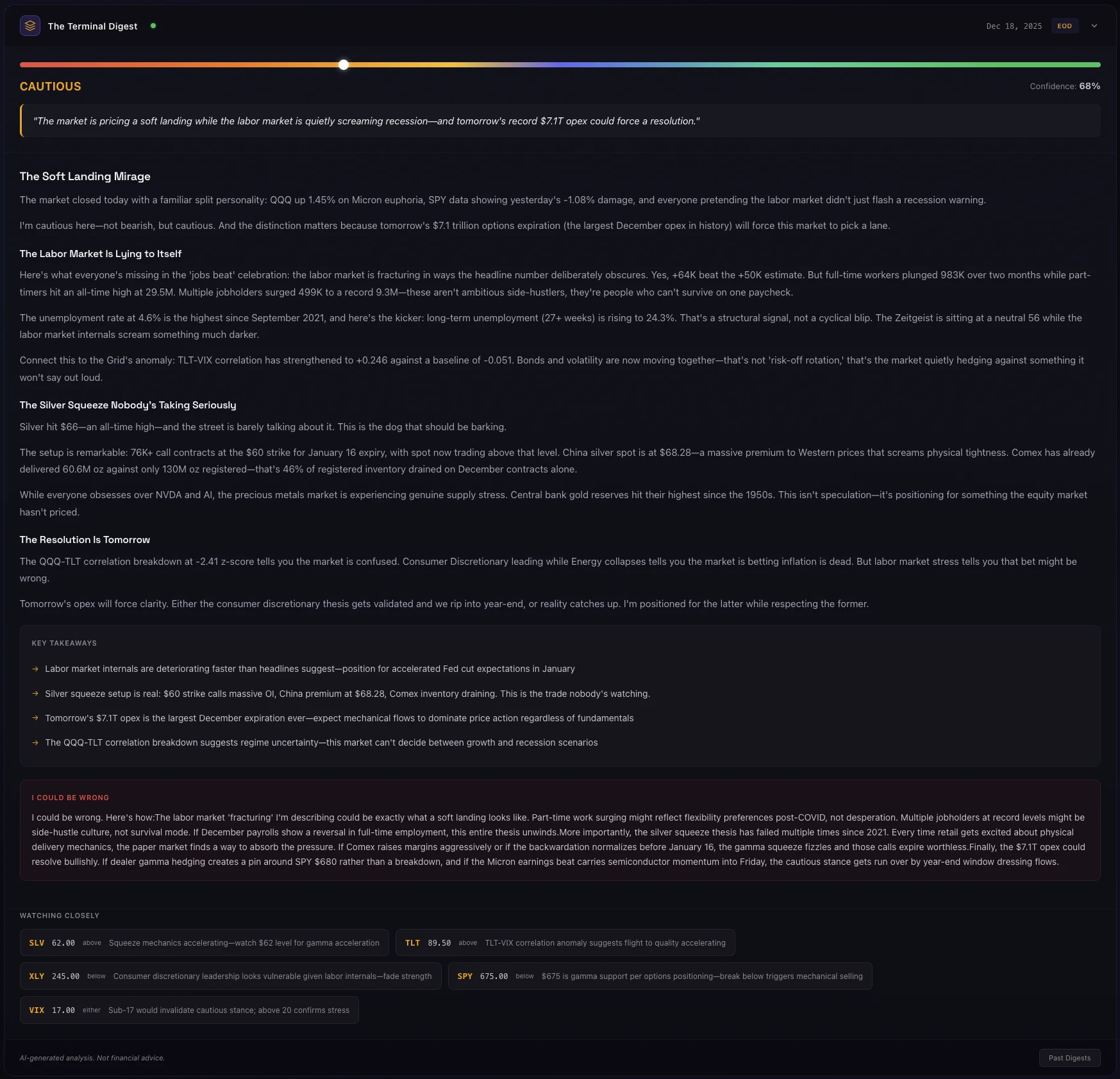

AI-synthesized daily market intelligence with actionable insights

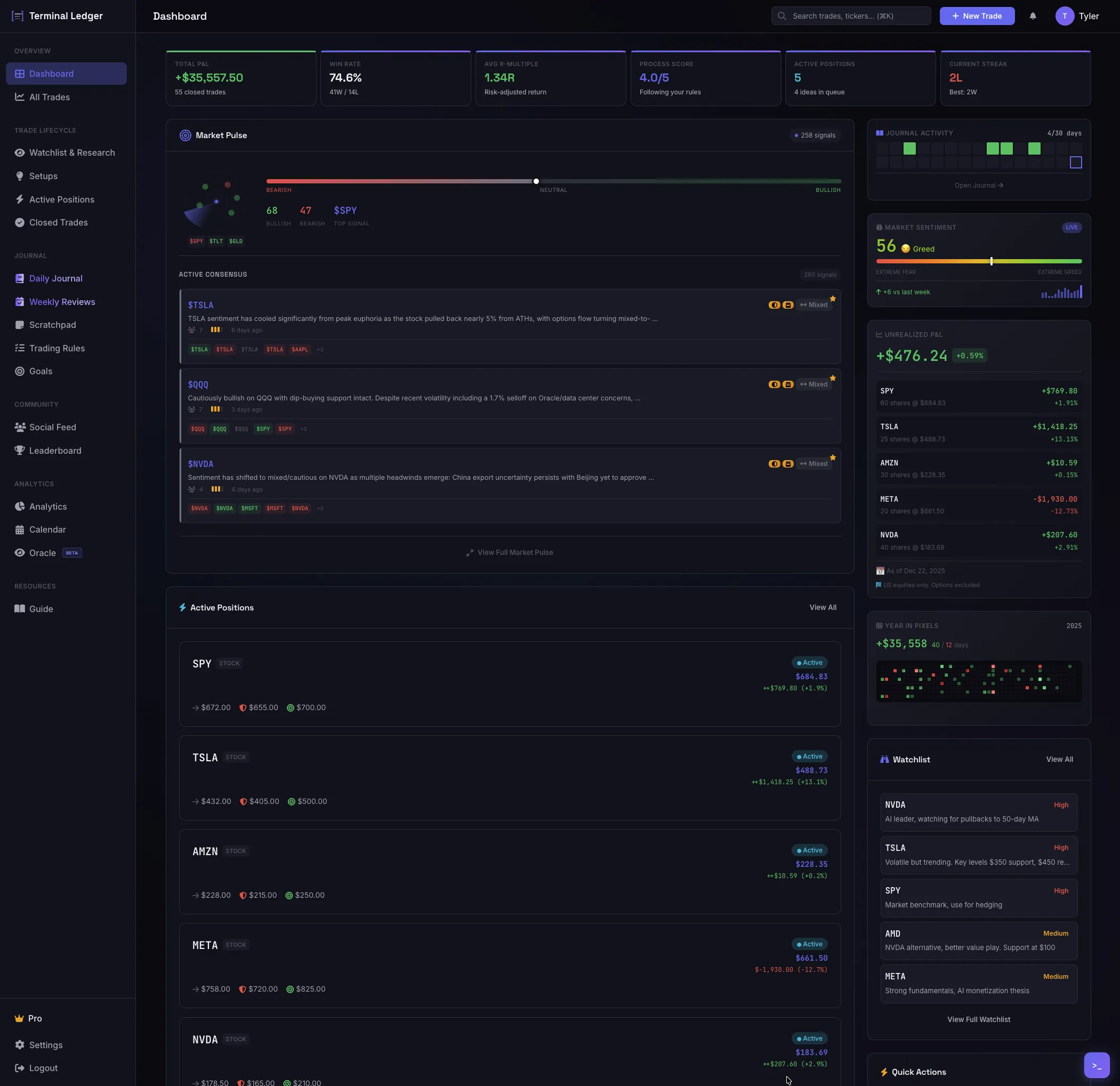

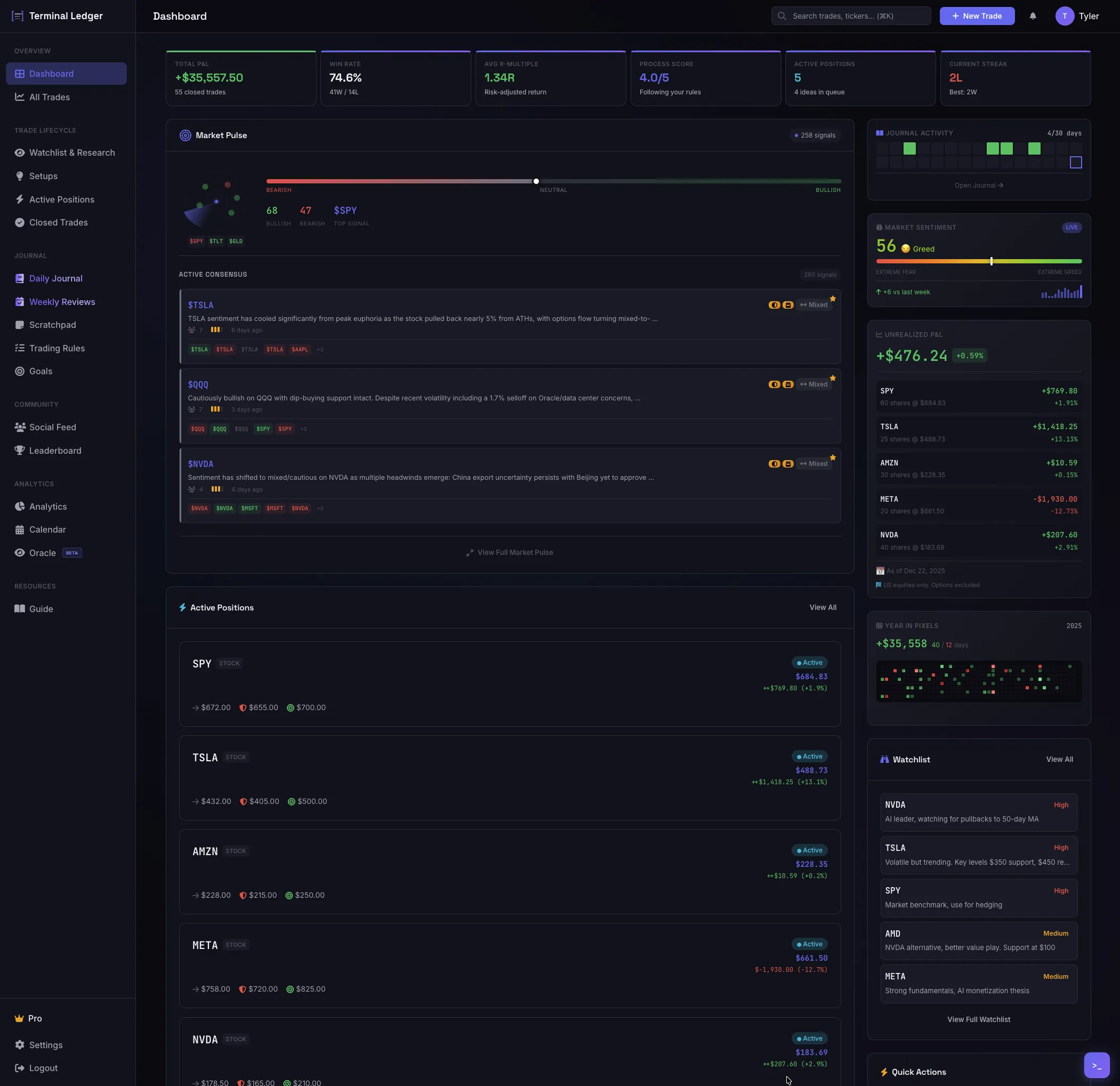

Your command center for market intelligence and sentiment

Track your P&L, open positions, and daily performance

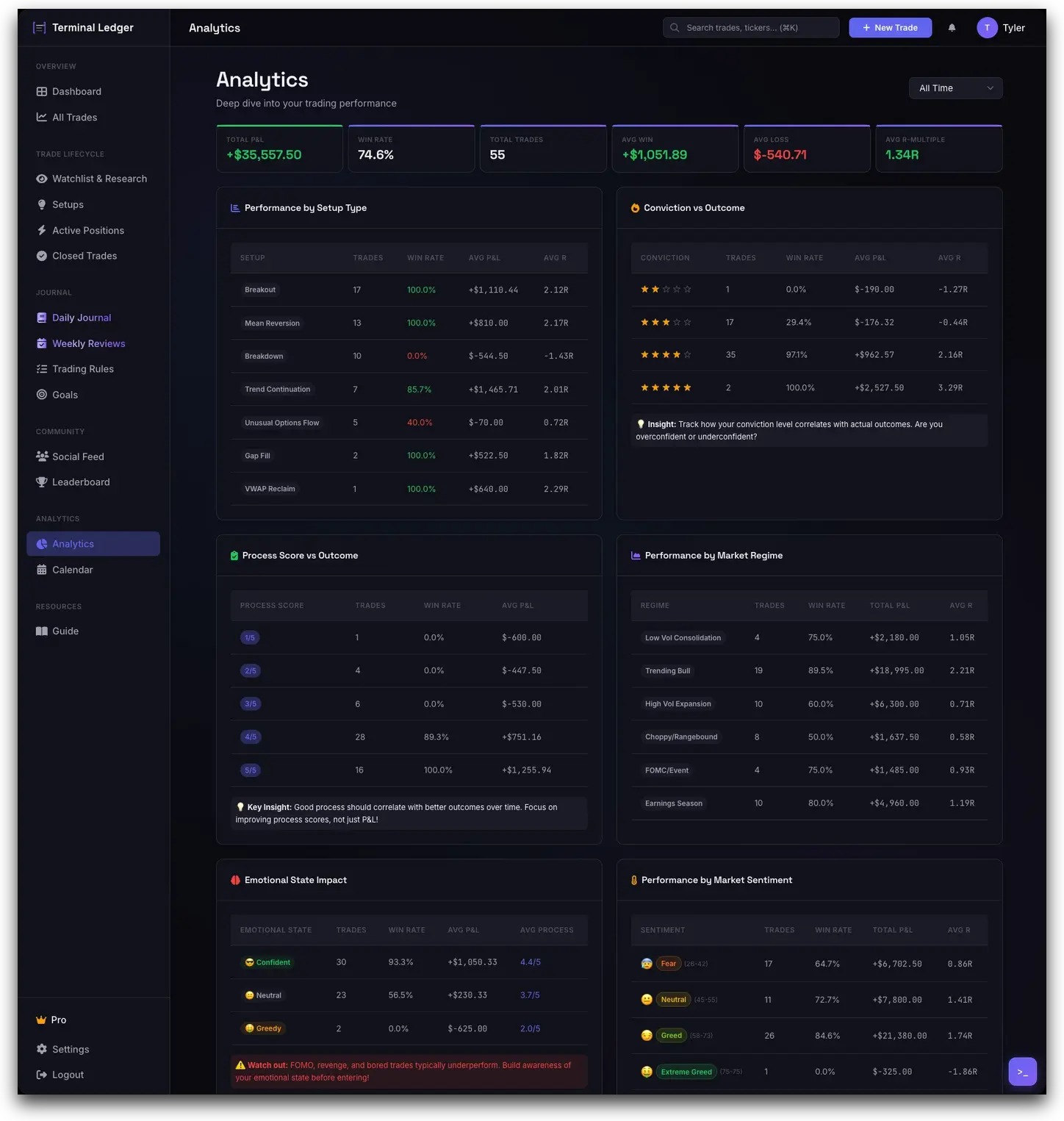

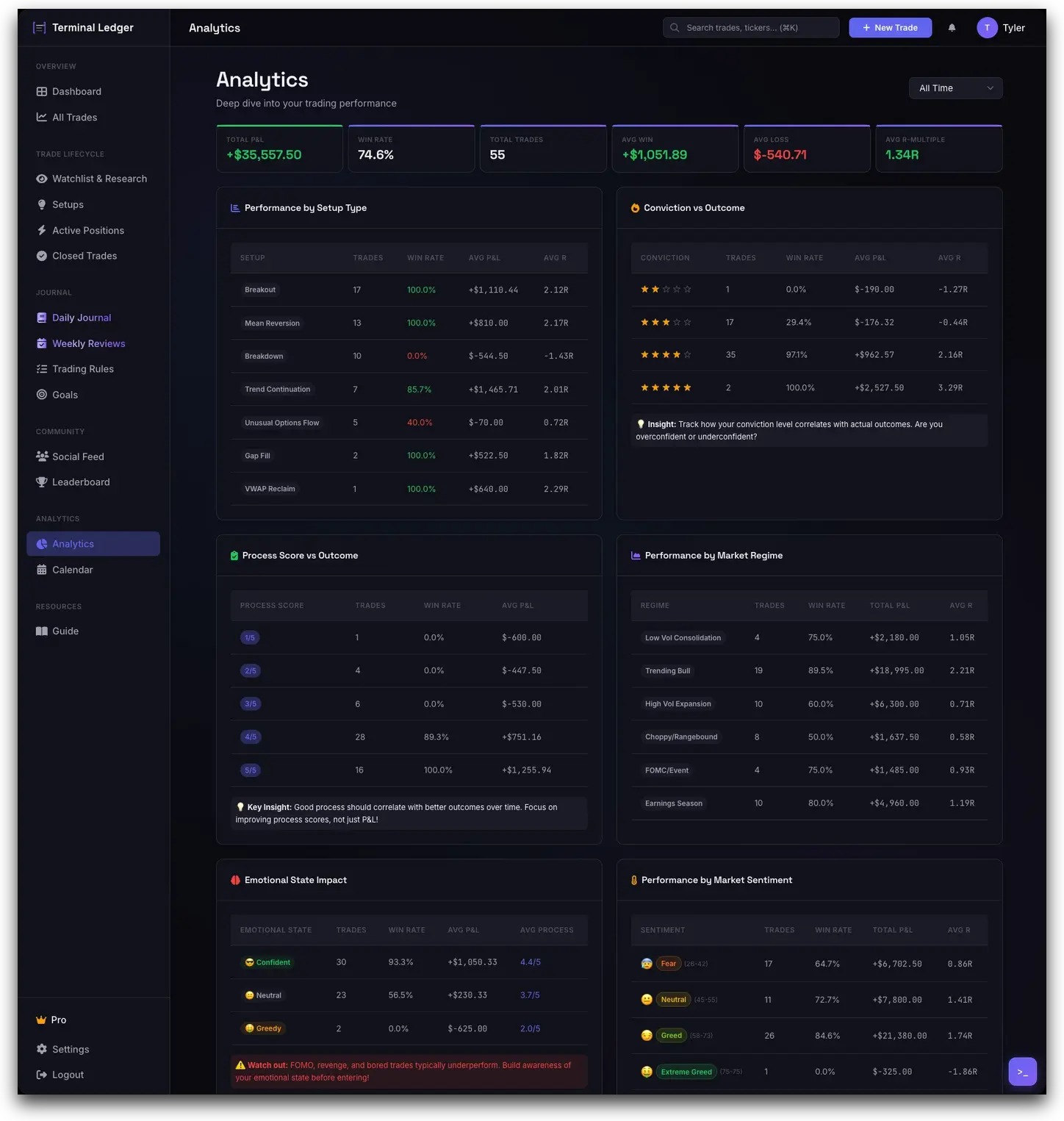

Deep insights into your trading patterns and edge

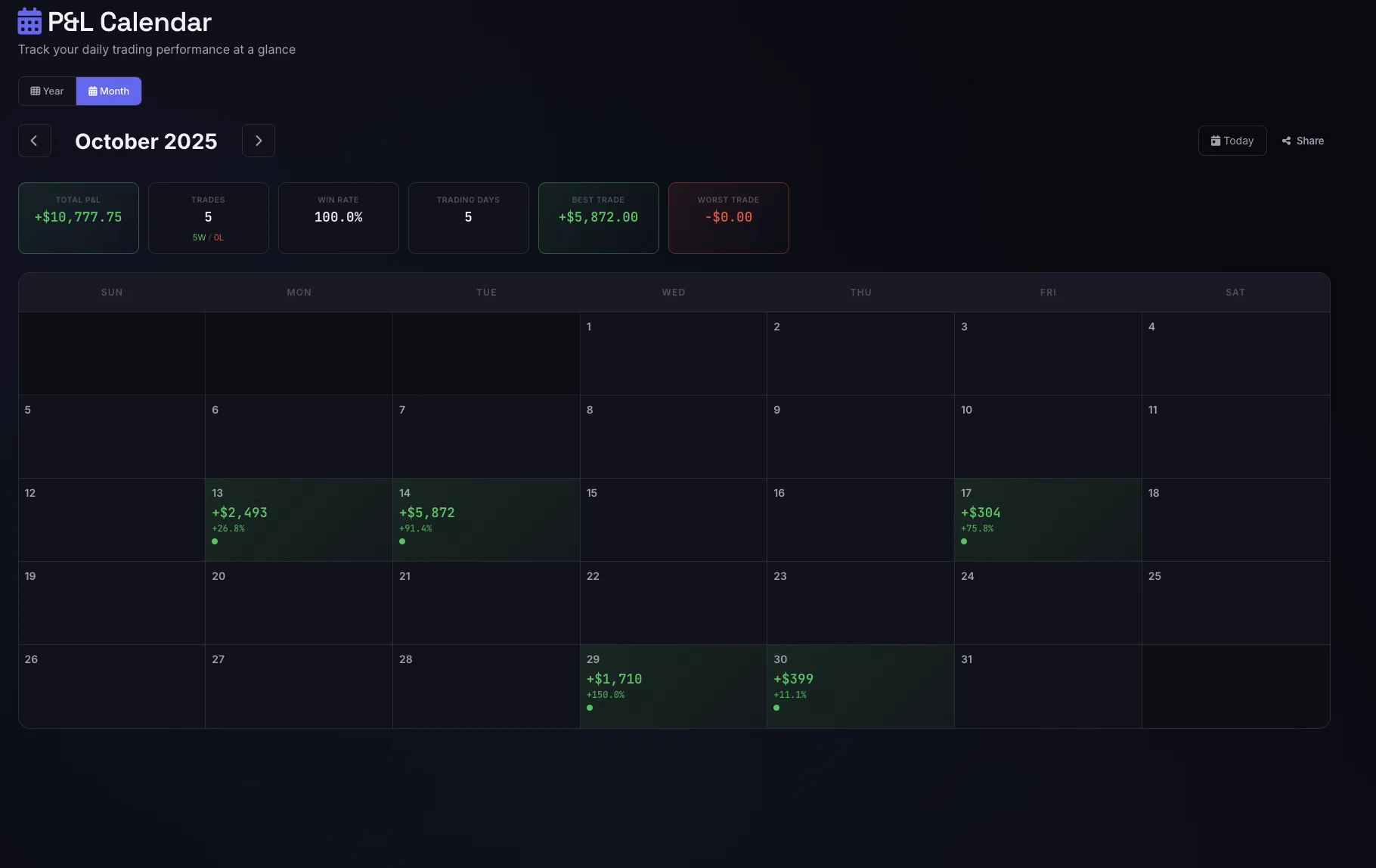

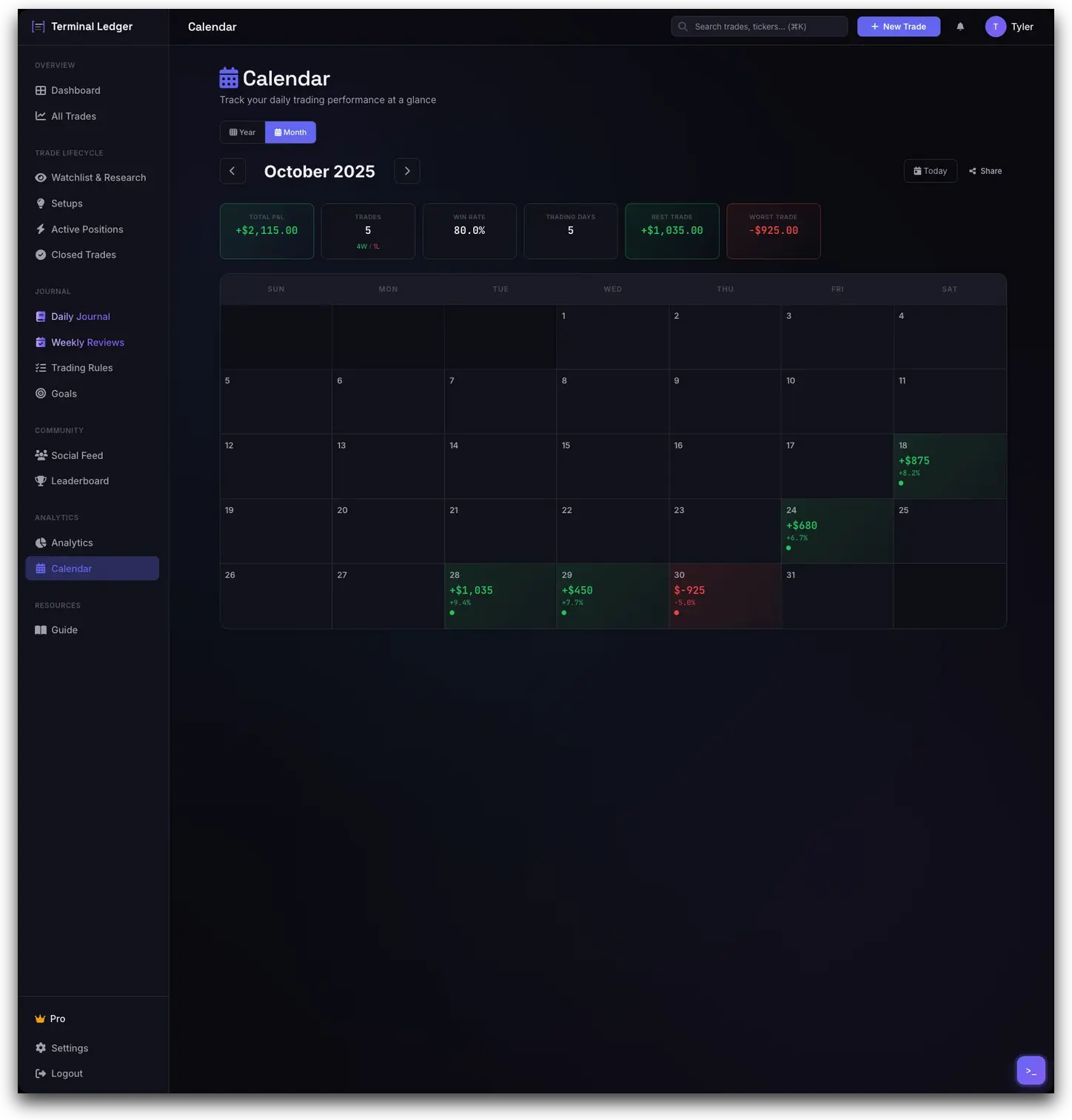

Visualize your daily trading results at a glance

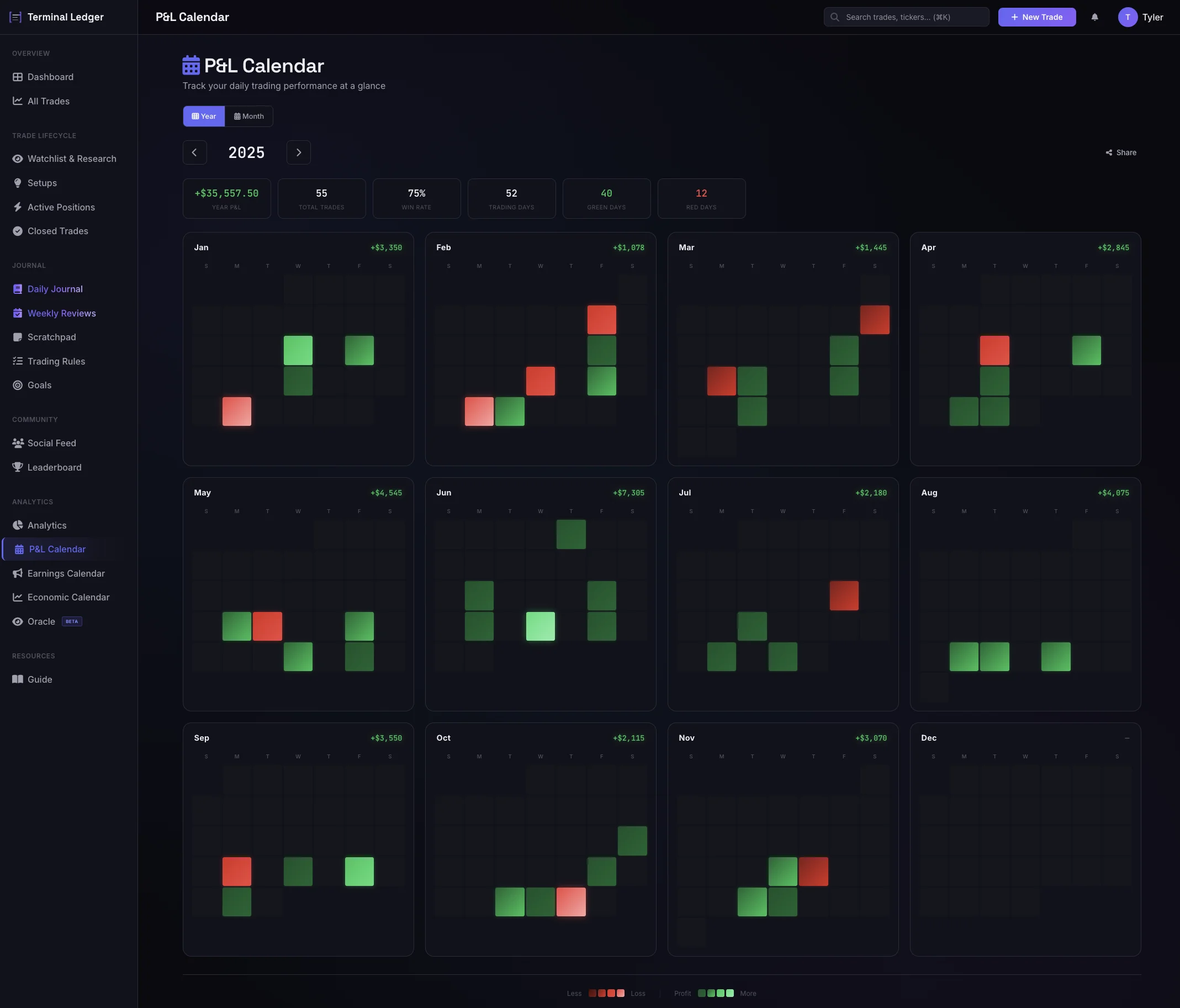

See your entire trading year in one powerful visualization

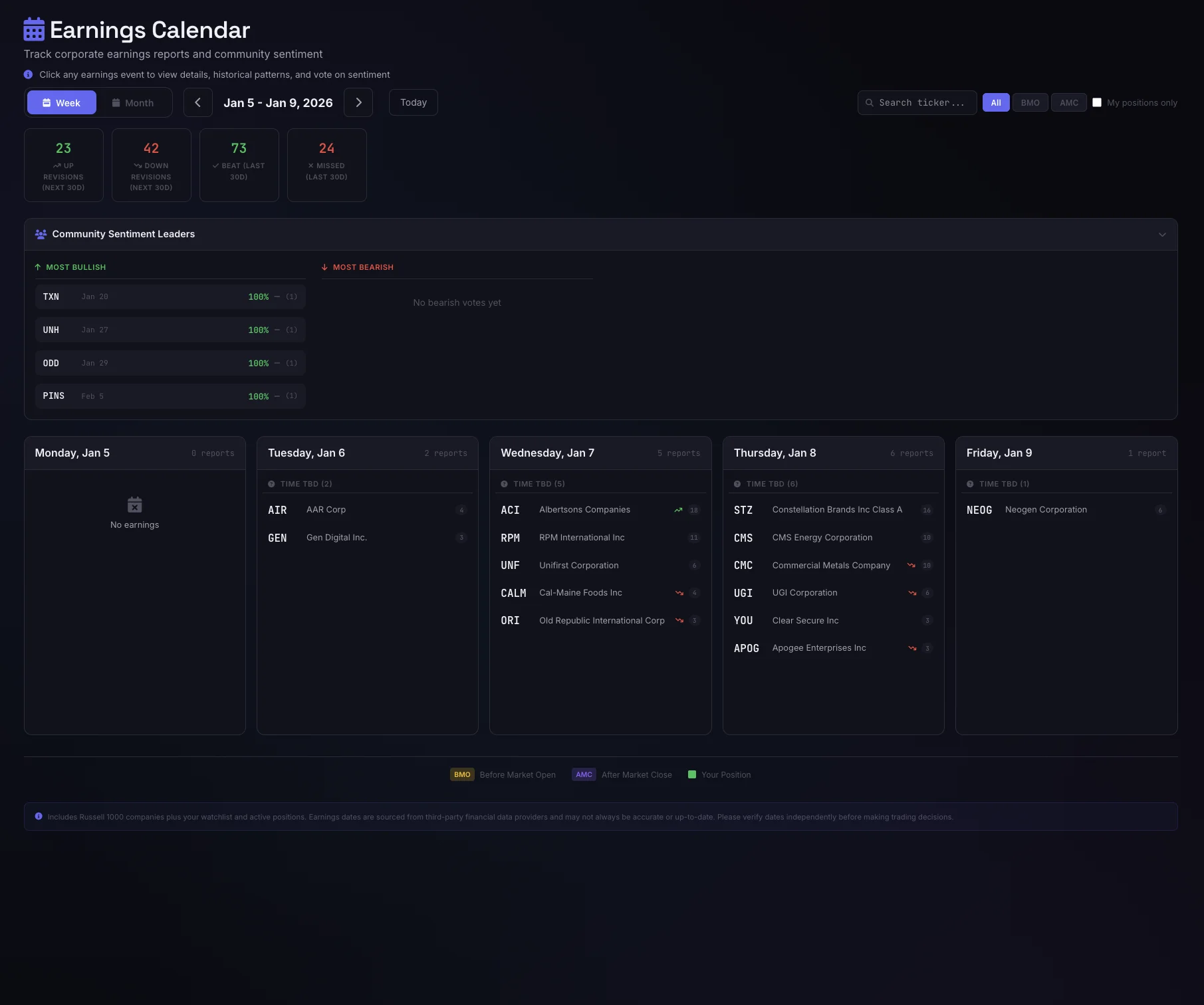

Track S&P 500 earnings with historical reaction patterns

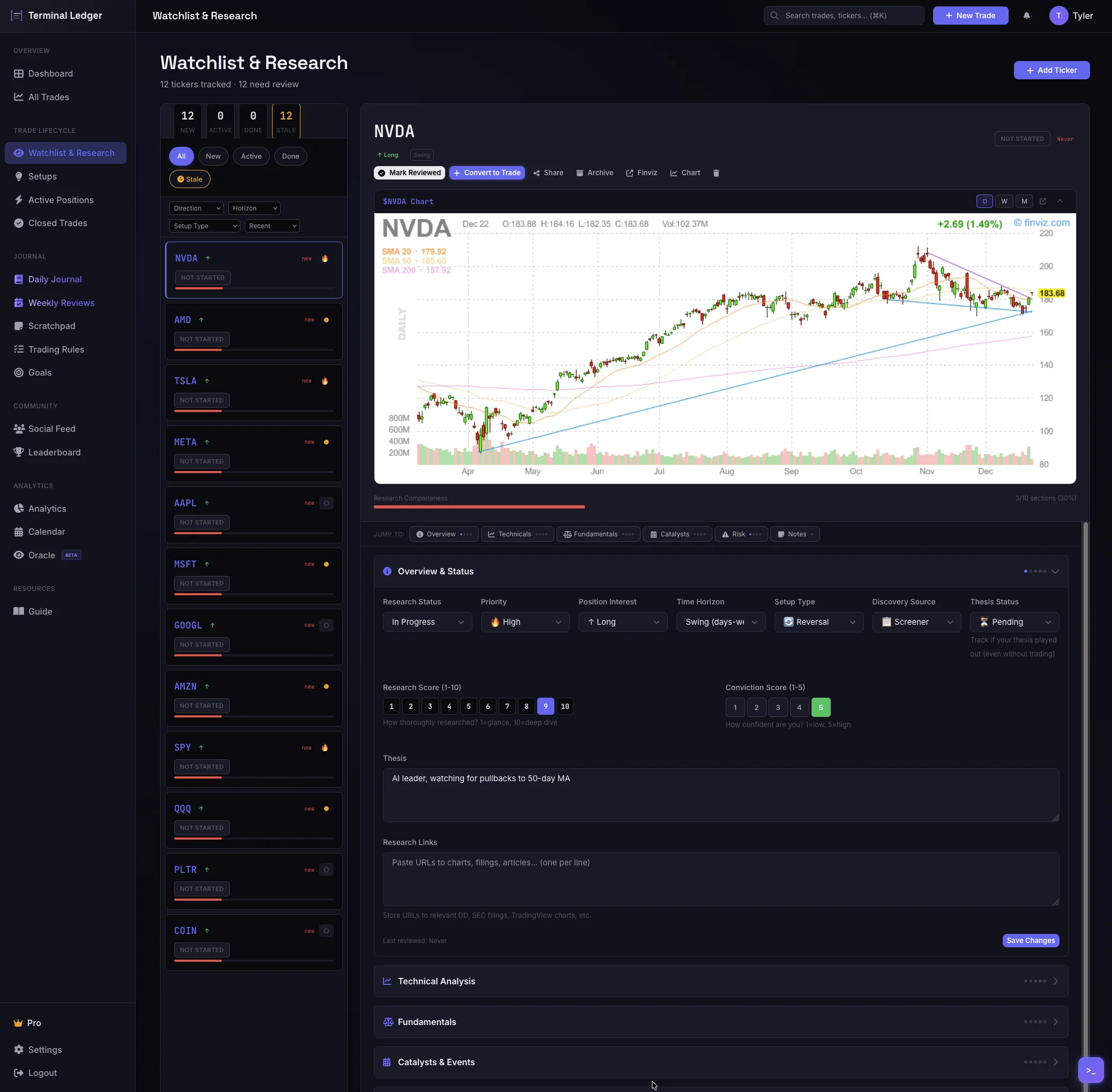

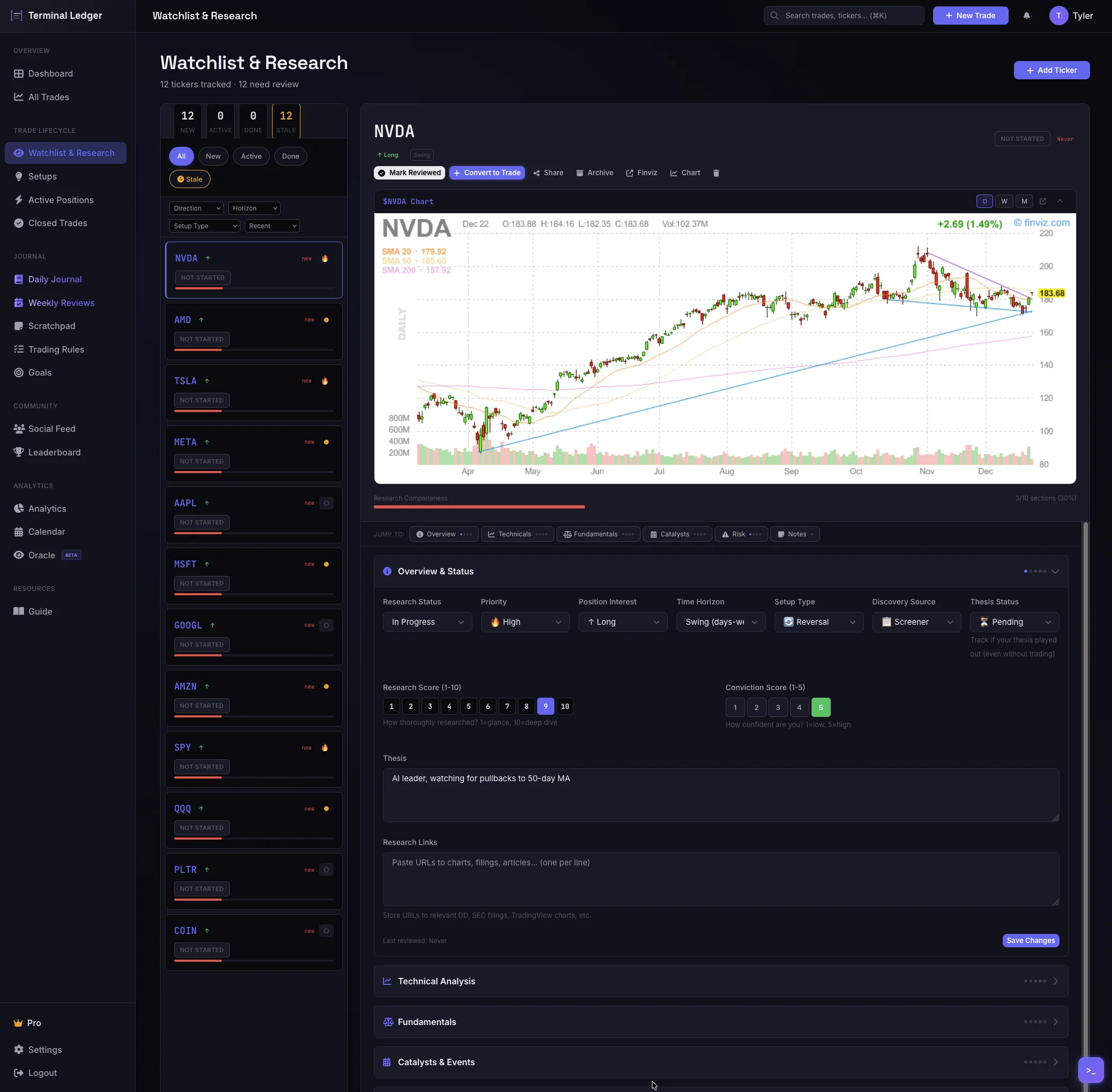

Organize your research and track potential opportunities

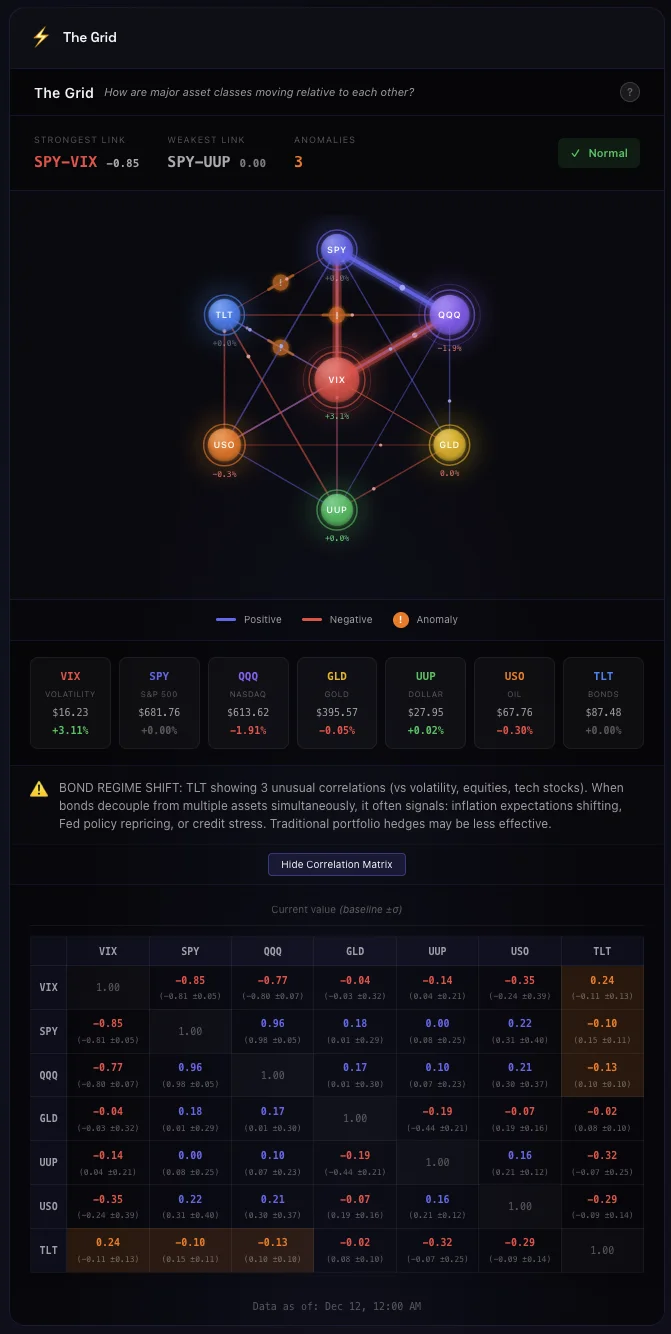

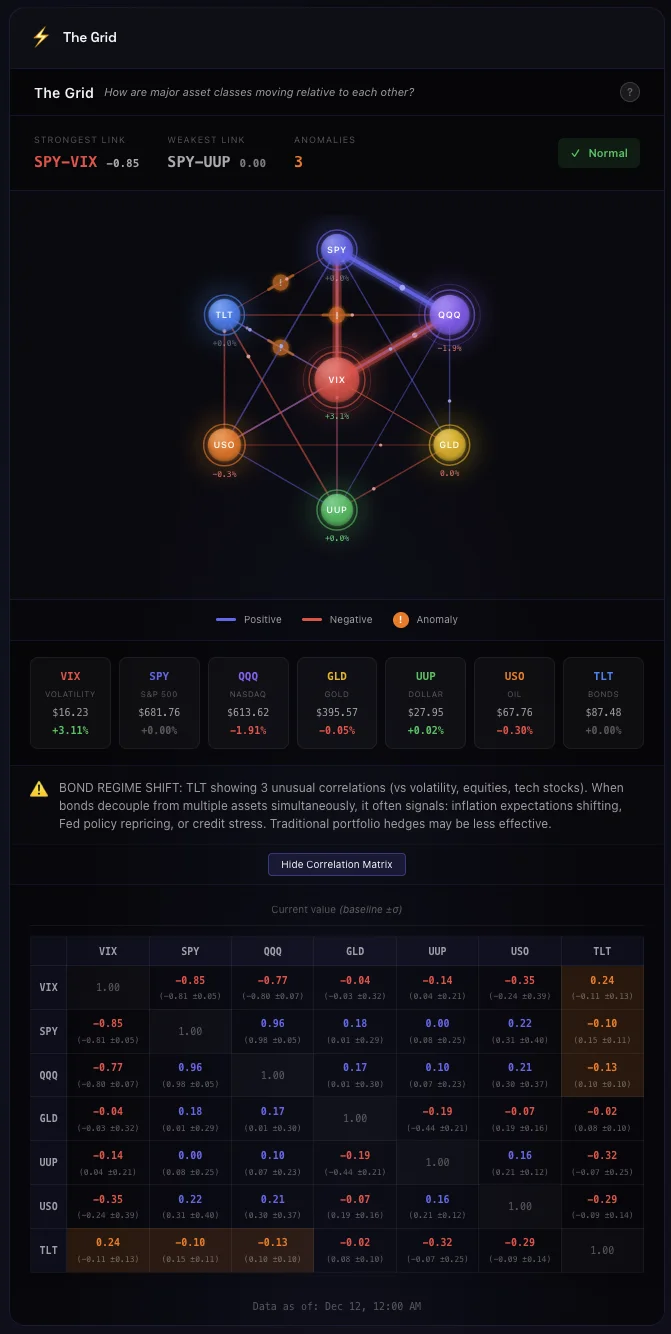

Spot intermarket anomalies before they become obvious

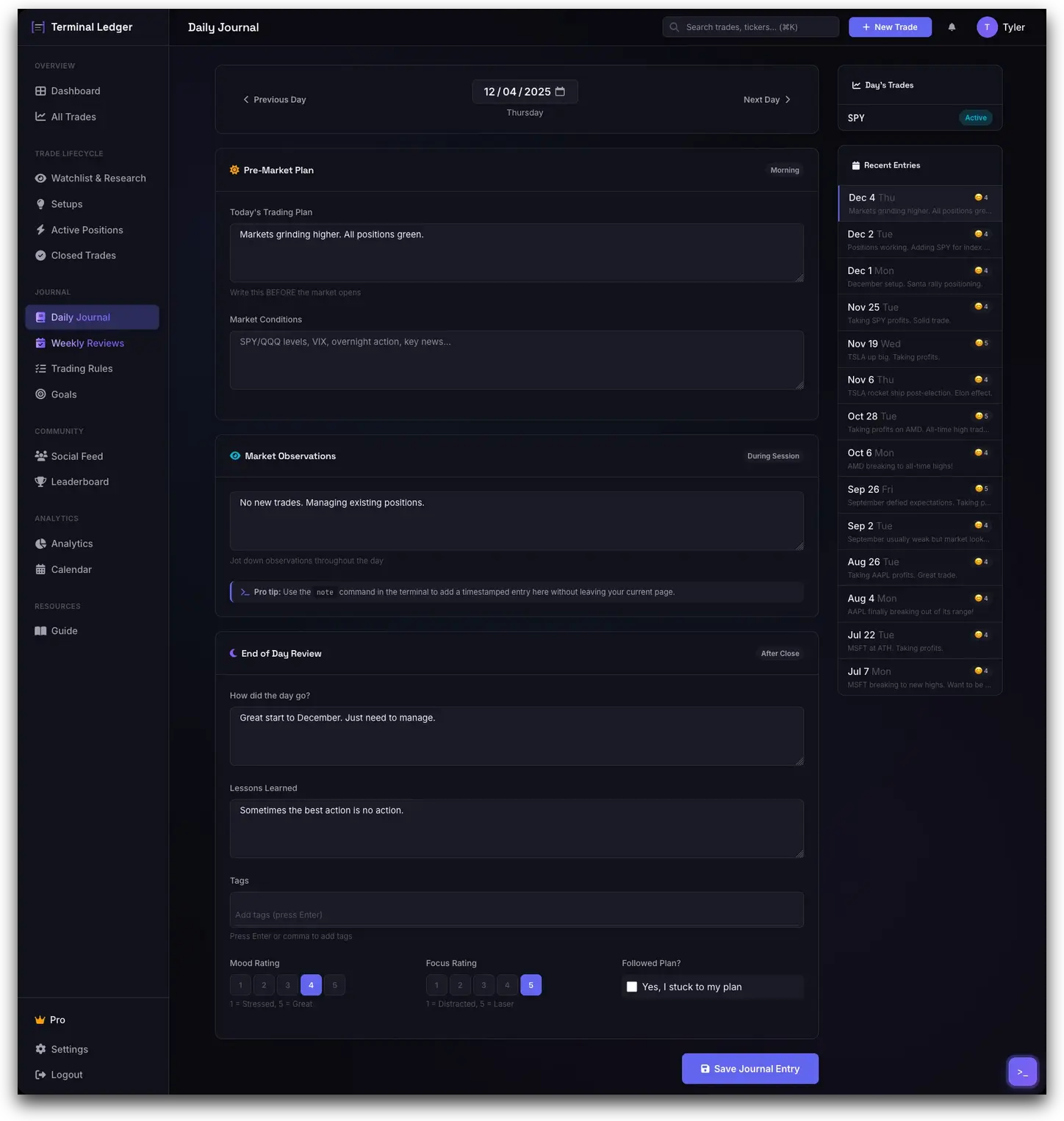

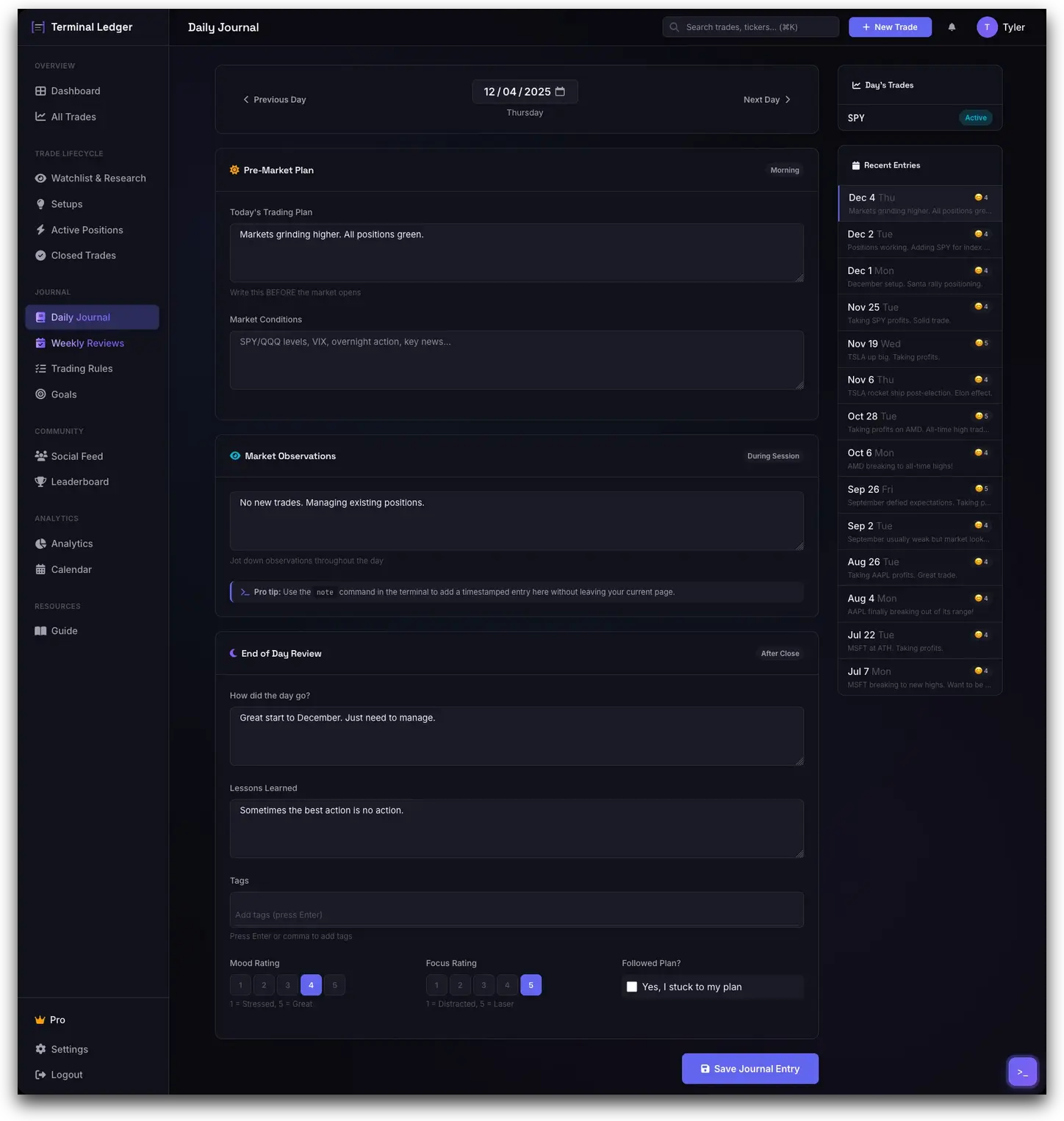

Capture your thoughts, lessons, and market observations

95% of traders lose money. Terminal Ledger breaks the cycle.

Same FOMO entries, revenge trades, and premature exits—over and over.

No data on which setups actually work. Trading on gut feel, not evidence.

Emotions drive decisions. Trading angry or anxious leads to losses.

Spreadsheets are tedious. Other tools are complicated. Habits never form.

Log ideas, track positions, review results. Complete lifecycle in one place.

Analytics reveal which setups, conditions, and states drive your best trades.

Track mood and conviction. See how your mental state correlates with P&L.

Pre-market plans, end-of-day reviews, weekly analysis. Pro habits, built in.

Purpose-built tools for traders who are serious about improvement.

Stop guessing. Our analytics dashboard breaks down your performance by setup type, market regime, day of week, conviction level, and emotional state—so you can double down on what works and eliminate what doesn't.

Professional traders have a routine. Our daily journal guides you through pre-market planning, market observations, and end-of-day reviews—building the consistency that separates profitable traders from the rest.

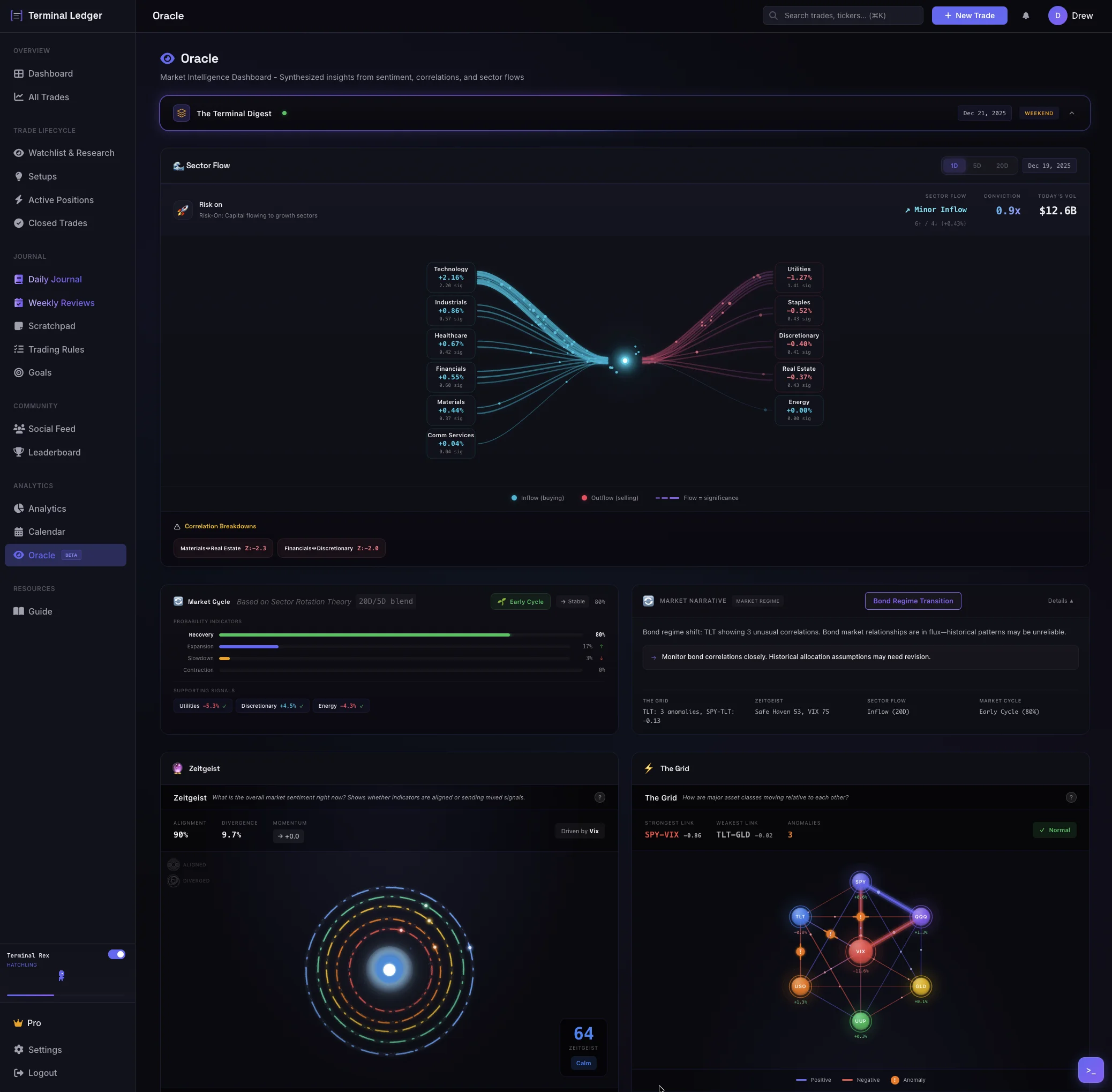

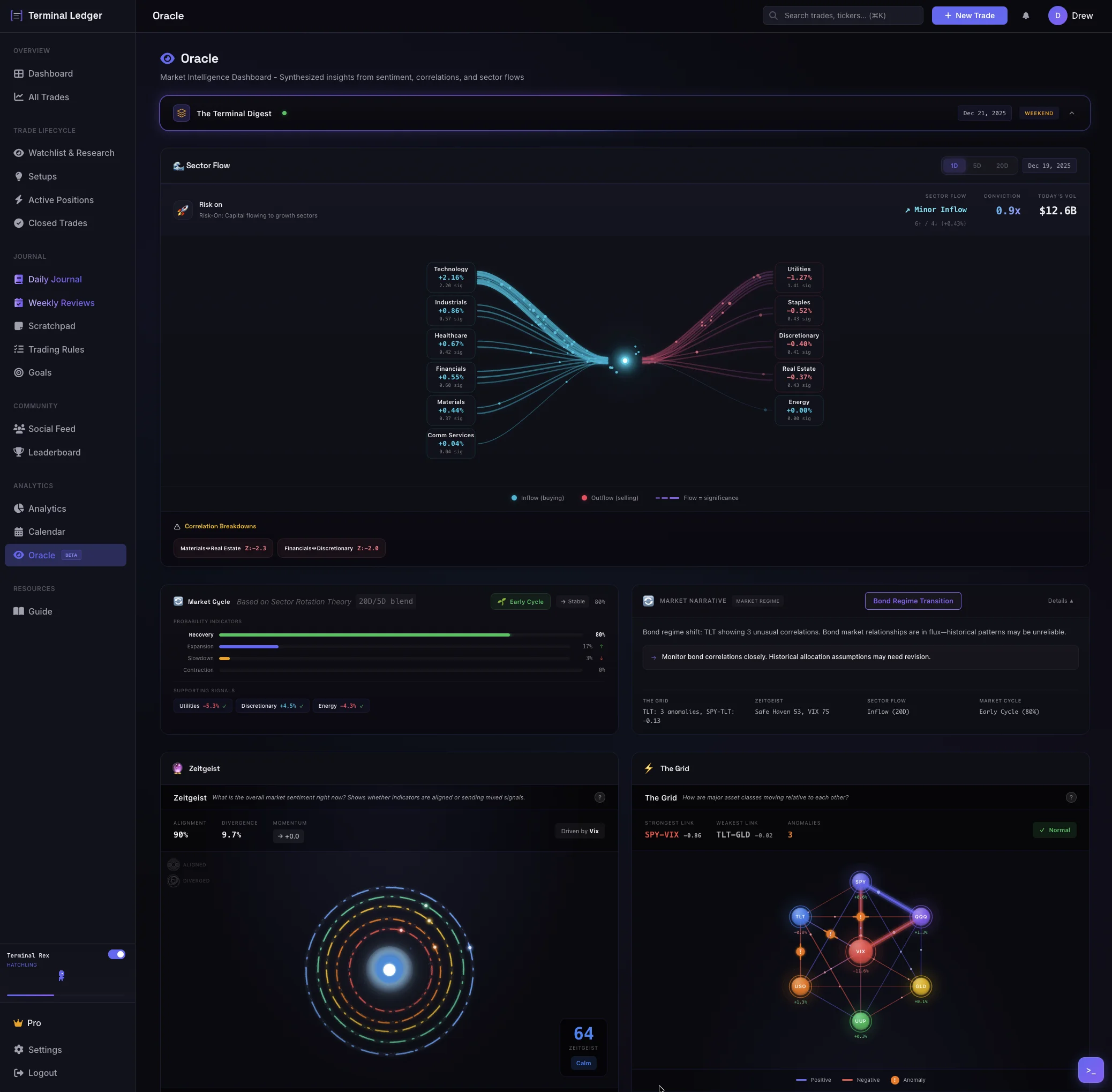

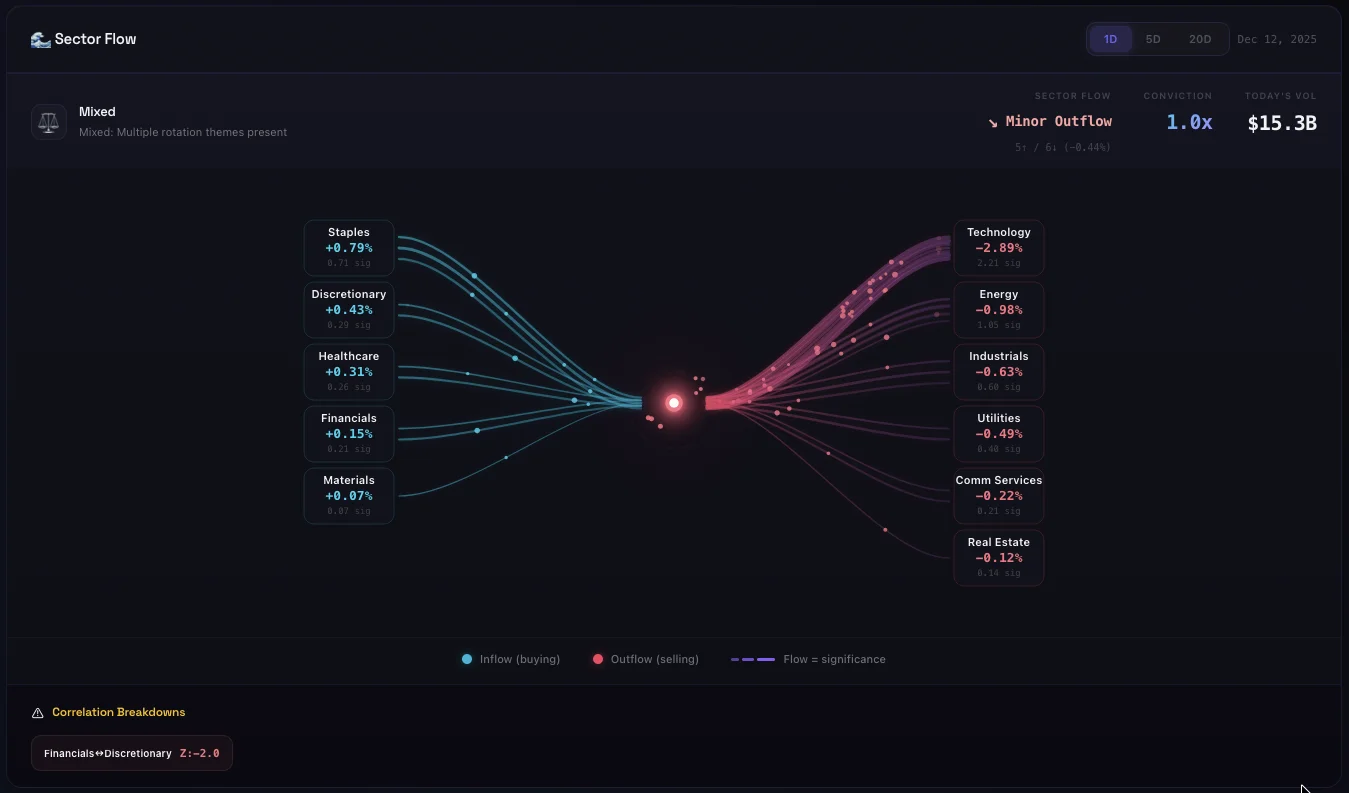

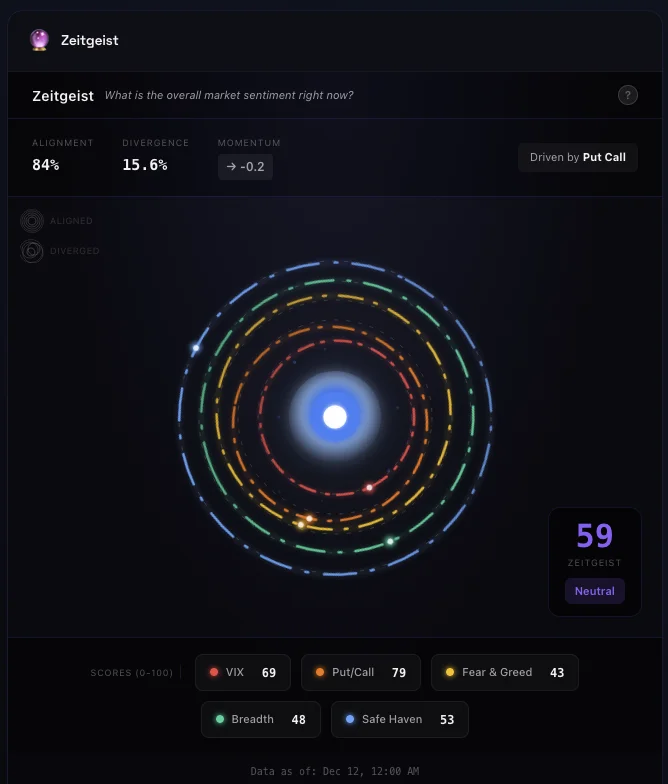

Proprietary market sentiment visualization powered by the Oracle dashboard. Understand sector flows, intermarket correlations, and regime shifts at a glance—so you can trade with the market, not against it.

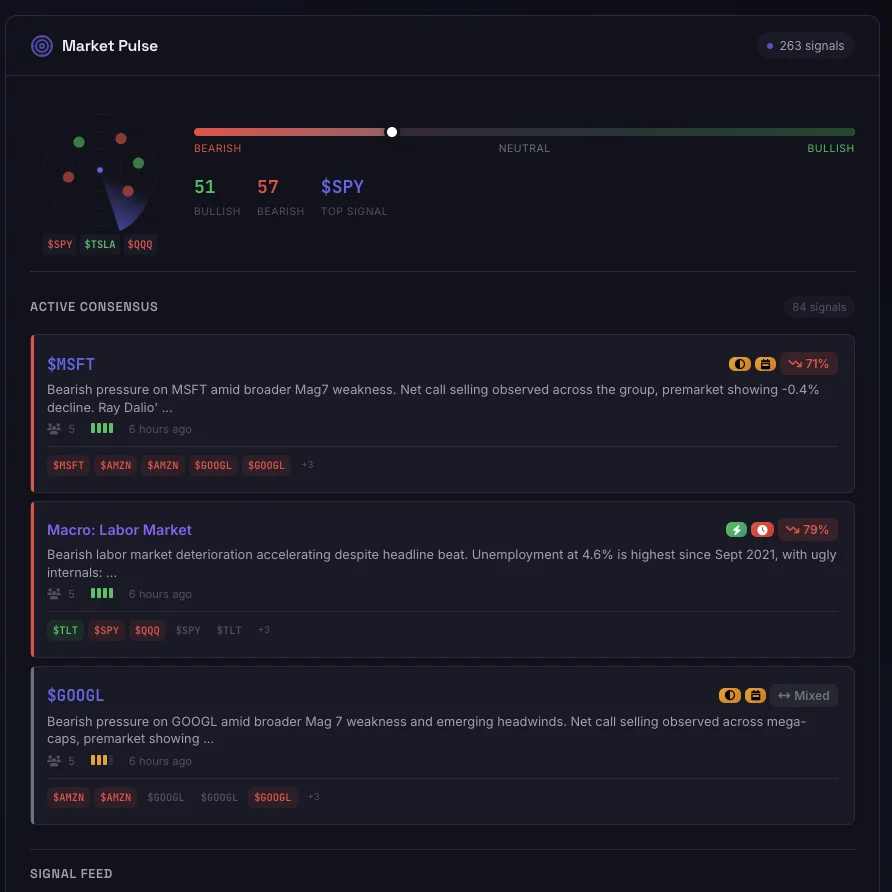

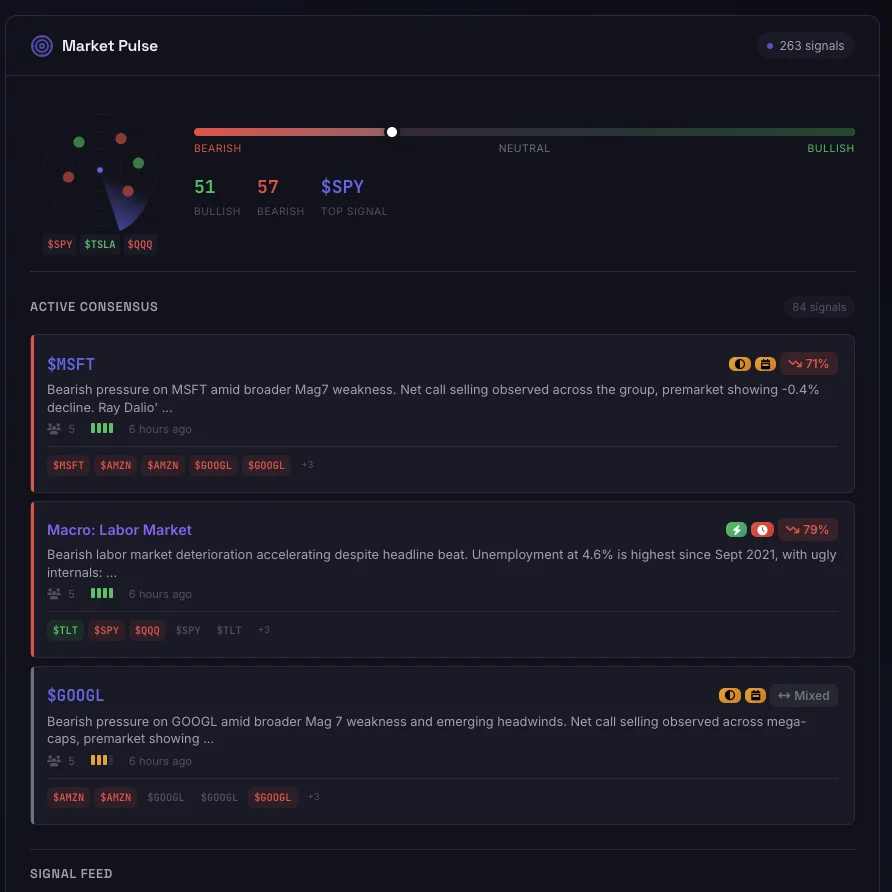

Stay ahead of the market narrative with curated social sentiment analysis. Market Pulse aggregates insights from verified financial sources, giving you a clear pulse on what's moving markets and why.

See your trading performance at a glance with our visual P&L calendar. Instantly spot patterns in your profitable and losing days, identify your best trading days, and track your journey to consistency.

Great traders don't chase—they prepare. Our research hub lets you track potential setups, document your thesis, and organize your ideas so you're ready to act when the opportunity presents itself.

A command-line interface for power users. Log trades with natural commands, get instant stats, and manage your positions faster than ever. Built for traders who think in keystrokes.

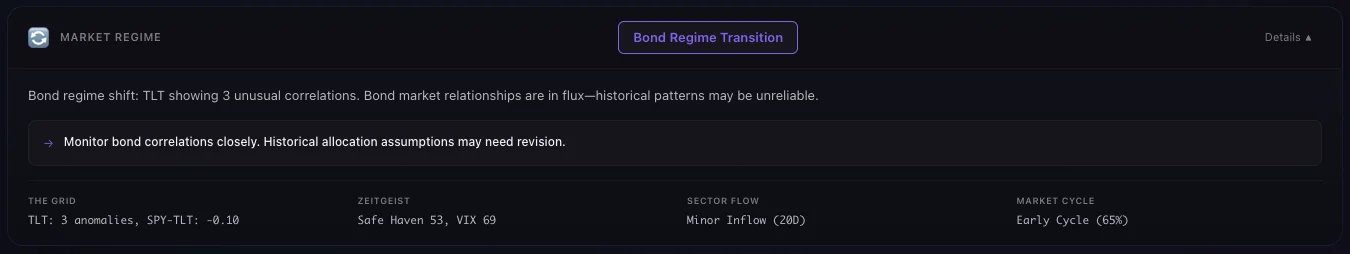

Proprietary market sentiment visualization. Understand sector flows, intermarket correlations, and regime shifts at a glance.

Sankey diagram showing money flowing between sectors. See where institutional capital is moving.

Synthesizes VIX, Put/Call ratio, Fear & Greed, breadth, and safe haven flows into one living sentiment indicator.

Neural network visualization of SPY, QQQ, TLT, GLD, VIX correlations. Spot anomalies before they impact your trades.

Sector rotation theory in action. Know if we're in recovery, expansion, slowdown, or contraction.

Synthesized regime detection across all indicators. Actionable context for your trading decisions.

Aggregated social sentiment from curated sources. Know what narratives are driving the market.

AI-powered daily market intelligence that synthesizes all Oracle data into actionable insights.

Start free, upgrade when you're ready to go pro.

Enter your trades with detailed thesis, strategy, and emotional state. Takes less than 2 minutes per trade.

Complete daily journals and weekly reviews. Build the habits that create consistency.

Use analytics to discover patterns. Double down on what works, eliminate what doesn't.

Terminal Ledger supports stocks, options (including multi-leg strategies like iron condors, spreads, and straddles), and more. We have 15+ built-in strategy templates, and you can create custom setups for your unique approach.

By design, no. We believe manual entry is essential to the journaling process. When you log each trade yourself, you're forced to think about your entry, your thesis, and your exit—building the reflection habits that create real edge. Terminal Ledger is about growth and deliberate practice, not just record-keeping. Most trades take under 2 minutes to log.

Absolutely. We use industry-standard encryption, secure sessions, and never share your data with third parties. Your trading information is private and protected.

Start with our free tier to explore Terminal Ledger with up to 15 trades per month. When you're ready for unlimited trades and Pro features like the P&L Calendar and Market Sentiment tracking, upgrade anytime—no commitment required.

Not at all! Terminal Ledger is designed for traders at any level. In fact, building good journaling habits early can accelerate your learning curve and help you avoid costly mistakes that more experienced traders had to learn the hard way.

Yes! Terminal Ledger is fully responsive and works great on phones and tablets. Log trades, review your journal, and check analytics from anywhere.

Join traders who are using data—not guesswork—to improve their results. Start your free account today.